7 Macro Trends I’m Watching and Their Impact on Inflation

We're facing an inflationary future--demographic decline, climate change, and rising debt will overwhelm the deflationary impact of AI and robotics.

I’ve long thought that the next 40 years will see significantly higher inflation than we’ve seen for the last 40. This post lays out my reasoning.

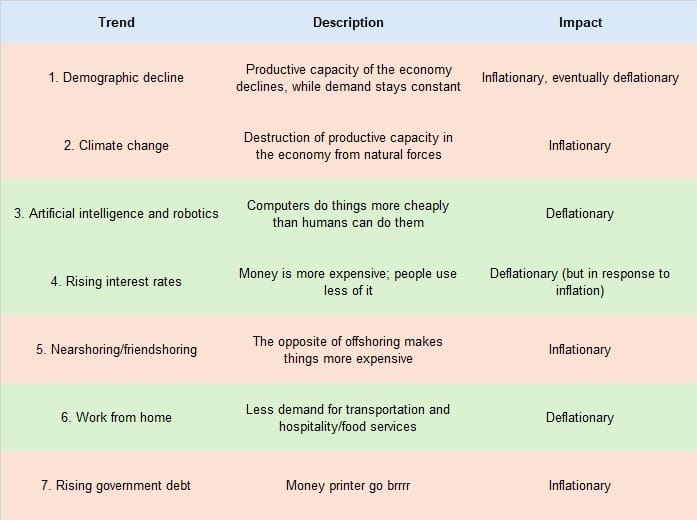

Here are the seven biggest trends that I see in the economy today and their impact on inflation:

The Big 4 Trends

I see the first four trends on the list as more impactful than the last three.

1. Demographic decline

Impact: Inflationary at first, eventually deflationary

Population Growth is Slowing

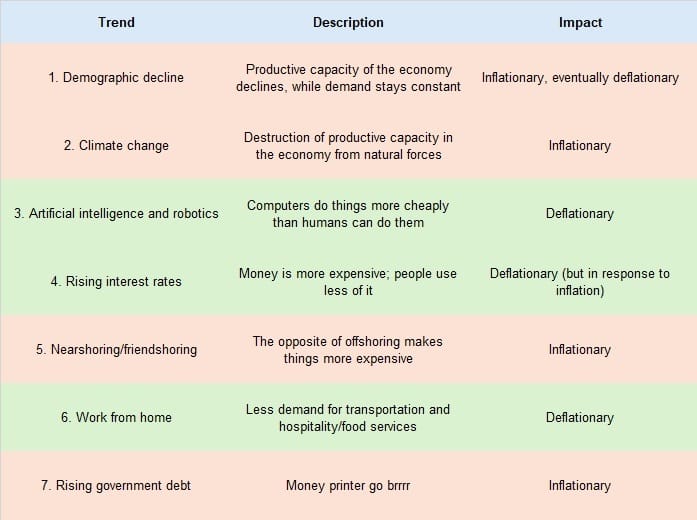

Falling birth rates and demographic decline have gotten a lot of attention in the press over the last two years. According to the CIA, 42 countries or administrative regions (of 237) already have shrinking populations as of 2024. Here are some standouts (highlighted in red):

Source: CIA World Factbook, 2024

Note how many of the big countries have low growth rates—e.g. France and Thailand—and these numbers are still falling every year. Many countries in Europe and east or southeast Asia are barely positive. I was shocked to see that India has a population growth rate only slightly higher than the U.S. as of 2024.

Incidentally, of the 30 fastest-growing countries, 28 are in Africa. Might be time to start looking at the investment climate and popular brands over there…

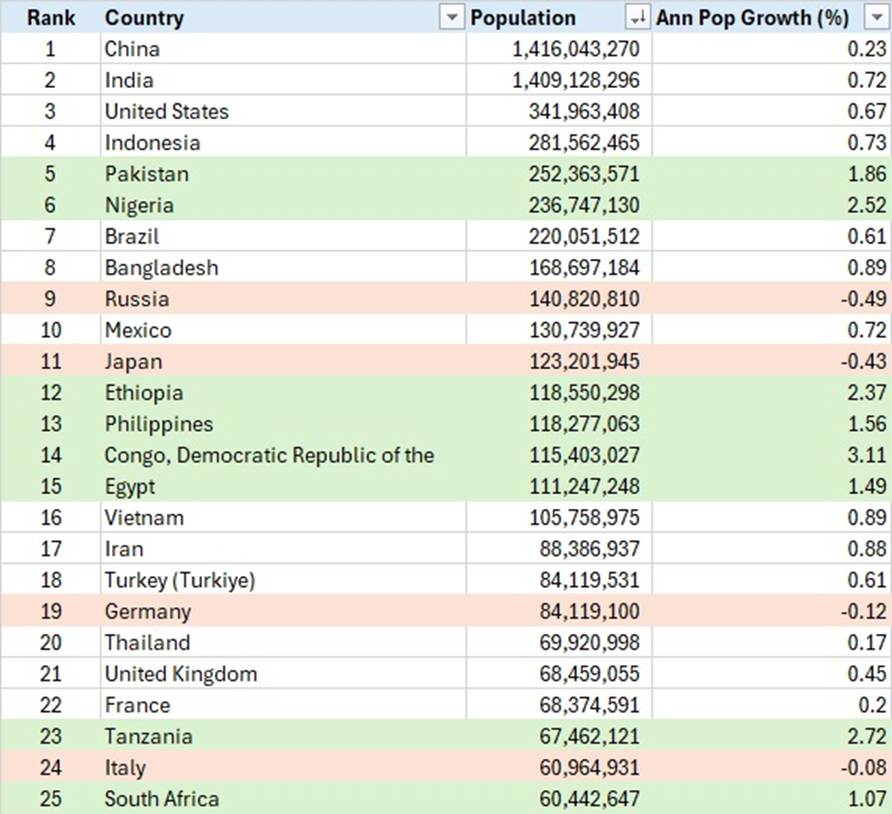

Humanity is Aging

Not only are population growth rates slowing down, the world’s population is getting older:

The median person in the world is still in prime working age, but the trend is towards fewer and fewer workers supporting more and more retirees. This trend is clearly inflationary—demand will stay constant (population is still growing until 2050 or so), but the supply curve will shift inwards due to the productive capacity of the economy shrinking due to fewer available workers. If the amount of food demanded by the world’s population stays constant, but there are fewer farmers, the price of food should go up.

I wonder if advances in technology will be enough to offset the decline in workers. Remember that over the past 10,000 years of human civilization, the population has been growing and technology has been improving. Now, one of those tailwinds is turning into a headwind.

In the long run, I see this trend turning deflationary. At some point the total population will start to fall, meaning less demand for finite goods like land and natural resources. Birth rates may stabilize as only people with a high desire to reproduce will pass their genes on to the next generation. Depopulation will probably be good for the environment, but it calls into question how economies based on perpetual growth will function.

2. Climate change and the energy transition

Impact: Inflationary

Climate change and the energy transition are going to be highly inflationary for two reasons: large-scale degradation of infrastructure from weather events (shifting the supply curve inward) and the need to build new electrified infrastructure (shifting the demand curve outward).

I’ll give one example of the new infrastructure needs: a report from the Electric Reliability Council of Texas (ERCOT) that gave a lot of people sticker shock two weeks ago. ERCOT is forecasting total electricity demand of 152 GW by 2030, a huge increase over last year’s estimate, and a huge increase over last year's peak electricity demand of ~86 GW. Almost doubling the amount of electricity produced in six years is a staggering number—if all that generation does get built, I would expect significantly higher prices for labor, solar panels, wiring, land, transmission lines, lithium for batteries, etc.

Regarding infrastructure degradation, two weeks ago, Dubai and other parts of the Arabian Peninsula saw the heaviest rainfall in the last 75 years. According to one estimate, the flooding caused $850 million worth of insured damage and the government has earmarked $544 million for property repair. These “once in a hundred years”-type events seem to be happening much more often than once every hundred years, don’t they? And everything Mother Nature destroys, humans have to rebuild. That costs labor and it costs capital.

(Incidentally, I remember studying a climate model a few years ago that forecasted that the Arabian Peninsula would get much more rainfall over the coming 30 years, to the point it would become green and lush rather than the desert it is right now. I wonder if that’s coming true. If yes, that’s a good reason to be bullish on the Middle East, on top of the favorable demographic trends.)

3. Artificial intelligence and robotics

Impact: Deflationary

Artificial intelligence

Everyone is writing about AI these days so I won’t repeat what I’m sure you’ve already read. I’ll offer just a couple of comments—

The Internet brought the cost of distributing digital content down to virtually zero (YouTube for video, Spotify/iTunes for audio, traditional websites and email for written). This has had major impacts on legacy media industries like newspapers, radio stations and movie/TV studios.

Generative AI is going to bring the cost of creating digital content down to virtually zero. I don’t think it will kill legacy content creators, just like legacy content distributors (e.g. concert venues, newspapers) found a way to survive. But in sum, I think AI will be highly deflationary (just like the Internet has been) because a lot of things you used to pay a human to do you can get a computer to do almost for free.

Robotics

It’s possible that powerful, highly capable robots may partially or totally offset the decline in workers from demographic decline. My favorite example is the Roomba, this little robot that sweeps and vacuums your house. It tends to get confused with some furniture layouts but it already saves people a lot of time on cleaning their homes (or saves money in hiring cleaners.)

Technology in general tends to be deflationary as it reduces the cost of doing things that people already do (e.g. the invention of tractors and fertilizer made the production of food a lot cheaper.)

Demand for energy and compute

I hear and read that running these AI models is extremely processing-power and energy intensive. Demand for chips has already led to inflation in NVIDIA’s stock price. If the infrastructure supporting AI and robotics turns out to be very expensive, the total deflationary impact of these technology advances would be blunted by the rising support costs.

4. Rising interest rates

Impact: Deflationary

I have a view that in economics, things revert to the mean over long periods of time. Since we have been in a low interest rate environment for the last 40 years, we’re more likely to see medium to high interest rates over the next 40, just based on a review of what interest rates have done over human history.

All else equal, raising the price of money means fewer people and firms borrow, which means fewer projects get undertaken, which means total demand for goods and services goes down.

Although I think this is a big trend that will have ripple effects throughout the economy, it’s not set in stone as it’s something that policymakers have direct control over (unlike the speed of technological change or people having kids). It’s also endogenous with inflation—higher inflation means policymakers will hold interest rates higher, while a deflationary environment will push them to lower interest rates. The causality isn’t in one direction.

3 Smaller Trends

I see these as 10-15 year trends rather than 40 year trends. Talking about them is in vogue right now but people might have totally forgotten about them by 2030.

5. Nearshoring/friendshoring

Impact: Inflationary

Nearshoring/friendshoring is the idea that countries want to move outsourced supply chain components away from countries that are politically hostile or far away to countries that are close by or politically friendly. COVID kicked this off. For example, the U.S. realized that it didn’t want to be totally dependent on distant and sometimes unfriendly China for critical medical equipment.

People did outsourcing because it was cheaper. Reversing that would make things… more expensive.

I do think this trend is overstated. Policymakers in Washington want to nearshore a great deal of critical industries (to reduce reliance on China’s manufacturing) but doing so isn’t easy. Based on my conversations with people in industrial supply chain, the network effects China has in manufacturing will be very difficult to replicate. For example, if you’re operating a factory in the U.S. and something breaks, your German supplier might need three days to get you a replacement part because of timezone and distance. By contrast, if something breaks in a Chinese factory, the supplier is in the same city and can have their own engineers and maintenance people at your facility in two hours. Your production line will be back up by the evening.

6. Work from home

Impact: Deflationary

I don’t know whether to even call this a trend—it happened suddenly during COVID, it seems to have mostly stuck, and now people are just trying to figure out the right blend of being in the office and working from home.

I think WFH is mildly deflationary. Demand for transportation services and food away from home has clearly fallen, but some of that has just been replaced with demand for other baskets of goods and services. Your company may spend less on office space, but you’ll spend more on housing as you want a dedicated home office. You may no longer get a bacon egg and cheese at the corner bodega or a fancy drink at the hipster coffee shop in the lobby of your Manhattan office tower, but you might buy an expensive espresso machine or some other breakfast cooking gadget.

7. Rising government debt

Impact: Inflationary

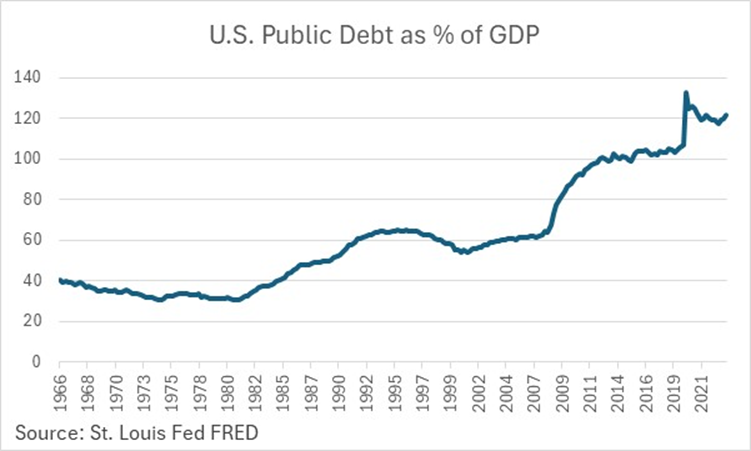

Government debt-to-GDP ratios have gone through the stratosphere in many countries over the last 20 years. Here’s what the ratio looks like for the U.S.:

Conceptually, I think of debt-to-GDP similar to a debt-to-income ratio for a person. A salary of $100,000 can comfortably support a mortgage of $300,000. A mortgage of $800,000, not so much.

For countries like the U.S., the debt load is getting less and less “affordable.” The total amount of debt is still going up in many places, faster than income is going up, and the interest rates on the debt are also going up.

Furthermore, there’s no guarantee that national income will continue to go up. GDP is a function of productivity and population. Although AI, robotics and other advancements may continue to boost productivity, if the total working population falls, it’s not clear if national income will go up, go down, or stay flat.

I think a big chunk of this debt has to get inflated away.

This is the funniest YouTube video I watched in all of 2020. I promise you it is worth 3 minutes of your time, with the volume on.

My opinion on the source of inflation is certainly a minority view among former Federal Reserve colleagues; in a nutshell, I look at the consolidated balance sheet of the central government and central bank as one entity. I see no difference between IOUs created by the central government and IOUs created by the central bank, as 1) they are fungible in financial markets and 2) the central bank is not truly “independent” (it is just another Article II agency that can be destroyed at will by Congress using its Article I powers).

The government issuing lots of debt is in and of itself inflationary in my view, whether or not the Fed monetizes it. So J-Pow revving up the money printer as shown in the video isn’t a necessary precondition for inflation.

Conclusion

On balance, I see the inflationary trends having a bigger impact on the price level over the next 40 years than the deflationary trends. AI/robotics is the trend with the most potential, and the most uncertainty—I have no way to predict how much cheaper things will become in the next 40 years because AI and robots do all of the work.

Let me know what you think.