Did You Know Japanese Debt-to-GDP is Declining?

Japan's debt-to-GDP is falling as nominal GDP growth outpaces debt accumulation—the inflation regime finally working after 30 years of trying. But bondholders are accepting deeply negative real returns. Why doesn't the market believe inflation will persist?

I didn’t.

There’s been a lot of chatter in the financial press about a selloff in Japanese bonds over the past two weeks, with the 40-year Japanese government bond (JGB) breaking a yield of 4%. The rise in yields has been accompanied by a rally in the Nikkei and a decline in the yen, driven by expectations for fiscal stimulus under the watch of Japan’s new prime minister, Sanae Takaichi.

Fiscal stimulus also means debt. Everyone also talks about how Japan is the most indebted major economy in the world, as measured by debt-to-GDP, and how further stimulus might push Japan’s debt burden to some point of no return.

Whenever the market seems overtaken by some dominant narrative, my instinct is to look at the data and see if I can draw the same conclusion. I agree with the recent price action; I think bond yields need to be higher. But not because of fiscal sustainability concerns, but rather because of future unrealized inflation.

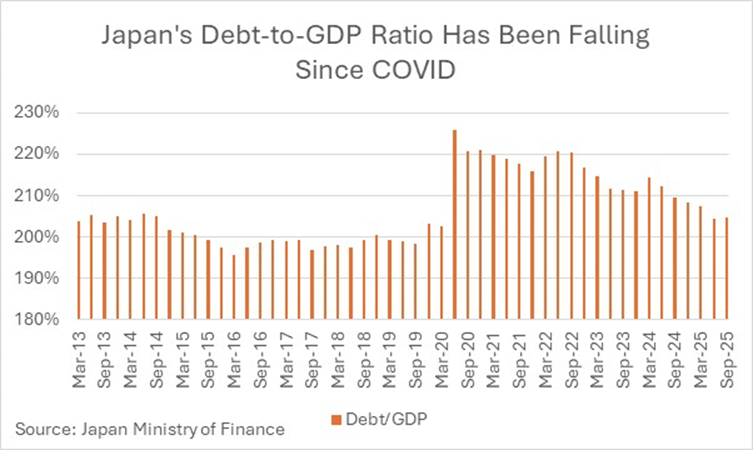

Japanese Debt-to-GDP Is Going Down

See for yourself:

How is this happening? Textbook arithmetic: nominal GDP is finally growing faster than government debt. This is also textbook finance—the most basic way to improve debt coverage ratios is to increase cash flow, in this case, by increasing GDP and the government tax revenue that comes with it.

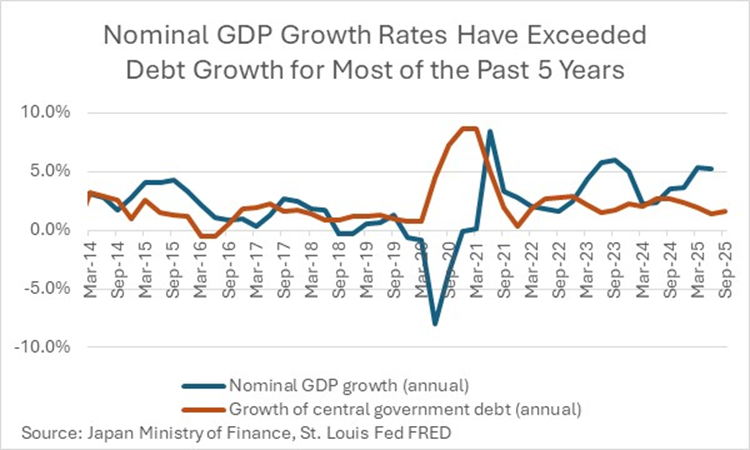

See below:

Nominal GDP growth has averaged 3.7% annually from 2021 through the present. Central government debt has been growing about 2.5% annually over the same period.

Japan Finally Got Inflation

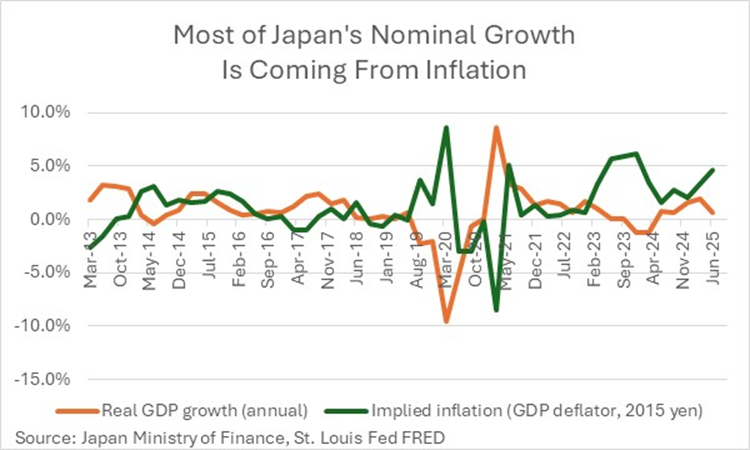

Unfortunately (fortunately?) most of the growth is coming from inflation:

This is not necessarily a bad thing, as Japanese fiscal and monetary authorities have been trying to generate inflation for the better part of 30 years. It appears that the COVID supply shock and subsequent fiscal stimulus have finally led to a sustained shift in the inflation regime.

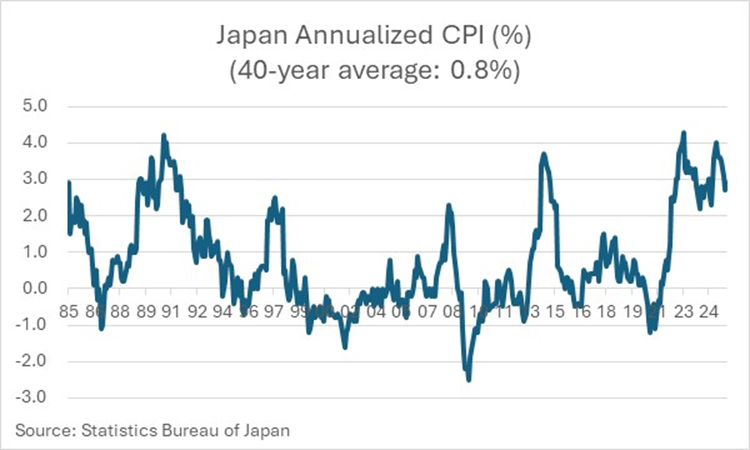

Just as a refresher, here is a look at Japanese CPI:

NB: The inflation numbers are a bit different, as the latter chart is measuring CPI, where in the former I used the GDP deflator to calculate implied inflation.

Why Isn’t the Bond Market Selling Off More?

So now what?

We have meager real GDP growth (~1.5% annual since 2021 and trending downward), above-target inflation (2.2-2.3% depending on the measure and trending upward), and the total stock of central government debt is increasing by about 2.5% per year. The debt/GDP ratio is falling, the yen is depreciating, and the stock market is on fire. The strategy of inflating away the debt burden—the correct policy choice in the eyes of many economists—is clearly working.

In sum, this looks like a yen debasement trade to me. The dynamics are similar to the U.S., except in America the debt burden is still rising. The big question to me is, why doesn’t the bond market care?

Here are some numbers, from year-end last year:

- 10-year JGB yield: 1.996

- 10-year JGB-I yield: 0.275%

- Breakeven inflation rate: 1.721%

- Realized 2025 CPI (Factset): 3.2%

- Implied inflation for 1H 2025, using the GDP deflator (Ministry of Finance): 4.0%

Obviously, the time periods are different on these numbers. But unless bondholders think that inflation is going to decline to below-target levels over the next 10 years (which is what the market prices imply), they are accepting deeply negative real returns.

Can We Trust Market-Implied Measures of Inflation?

Something about all this is just not sitting well with me and I can’t put my finger on what.

Everybody knows that the way out of these debt burdens—and most likely the political path of least resistance—is to pump nominal GDP while keeping annual deficits under some kind of control, which is exactly what Japan has finally succeeded in doing. But in a society with tepid real growth facing accelerating population decline, I don’t see where robust real growth comes from, fiscal stimulus or no. That means the nominal GDP pump has to come from inflation.

Gold prices—perhaps retail mania driven, perhaps not—support this narrative, that countries like Japan and the U.S. will have to debase their currencies to get out of their respective debt holes. But the bond markets, and particularly market-based measures of inflation, are behaving in a mostly benign way. Japanese bonds have been selling off, and going from 0% in the yield curve control era to 2.25% today is a notable move. But if you want a 1% real return, and you buy this nominal GDP pump story, then yields need to be north of 3% and probably even higher.

My suspicion is that there is that inflation-linked bond markets are structurally broken, which I’ll explore in a future piece.

Would love to hear your thoughts and feedback.

Three Interesting Reads

For those interested in more macro deep-dives on Japan:

- The Japanese Ministry of Finance’s Public Finance Fact Sheet

- A Peterson Institute report on Japan’s aging society

- Richard Koo’s The Holy Grail of Macroeconomics: Lessons from Japan’s Great Recession (affiliate link). Easily the best book I’ve read on the mechanics of balance sheet recessions.