Fedwatching: Data update, FOMC matrix for the 31 Jan 2024 meeting

Thoughts on the upcoming Fed meeting and recent data releases

- There won't be any movement on interest rates at tomorrow's Fed meeting--which should be a snoozer--but Friday's jobs data will draw a lot of attention. A strong jobs report pushes the prospect of rate cuts further out.

- Real GDP expanded by 3.3% in Q4 2023 according to the advance release, down from 4.9% in Q3 but well above the expectations of many FOMC voters. All else equal, GDP growth at above-trend levels pushes the prospect of rate cuts further out (if the economy is doing fine, why cut rates?)

- PCE inflation increased by 2.6% annualized in December, according to Friday's release. Excluding food and energy, the figure was 2.9%, with services inflation increasing at a year-over-year rate of 3.9%. These data are consistent with the view from several FOMC voters that the supply chain-healing is largely done, and further declines in inflation will have to come through services disinflation.

- Personally, I'm pessimistic that services inflation will decline to within the Fed's target. Looking into the data, the services sectors that have seen the steepest price increases are health care and food services. In health care, home health care saw inflation of >8% and specialty outpatient care saw increases of >10%. Looking at the job openings data, health care and social assistance was the job category with the highest number of total vacancies at ~1.7 million and a vacancy rate of 7.3%, the highest of any subsector measured by the BLS. Accommodation and food services had the 3rd-highest vacancy rate at 6.4%. I don't think this shortage is going to go away anytime soon barring changes in immigration policy--demand for health care services will only go up as the population gradually ages.

- The overall job market may not be as strong as the data indicate, however. Last month's payrolls report highlighted downward revisions of 71,000 jobs from October and November, and the labor force participation rate fell by 0.3%. It's not clear why the labor force participation rate fell--is it that people are retiring, people want to find jobs but can't find something that meets their qualifications, or some other reason. High-profile tech layoffs seem to be continuing at a steady drip, up to ~25,000 according to this tracker.

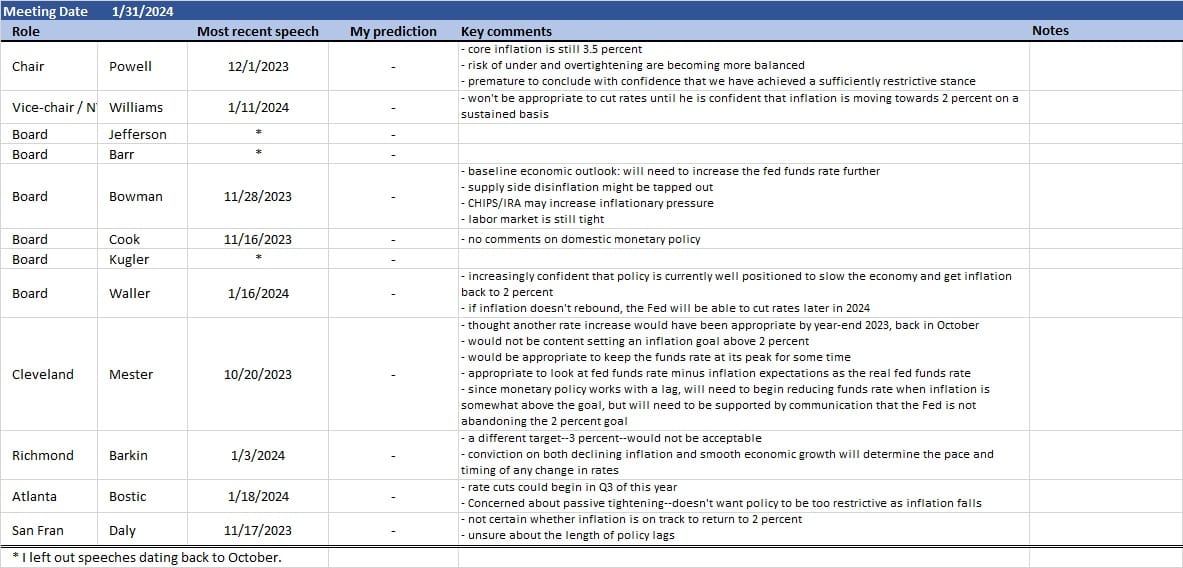

Updated FOMC matrix below: