The Federal Reserve Meeting Minutes, Barkin’s Speech, and the Interest Rate Outlook for 2024

A new year, a new monetary policy update.

A lot of people have been asking me “when” interest rates will return to “normal” levels rather than the “high” levels they are currently at (NB: interest rates are not high right now by historical standards). Everyone seems to think it’s a given that interest rates will go down this year. I’m not so sure. In this note I dig into the minutes from the Fed’s most recent meeting and remarks from FOMC voters to understand the criteria under which the Fed will cut rates.

TL;DR

· If inflation continues to decline at the current trajectory, and labor shortages moderate, the Fed is probably done hiking rates for the year. The Fed may even cut rates slightly by the end of the year.

· Inflation continuing to decline at the current pace is a big “if”. Several FOMC voters appear to think that the low-hanging fruit in fighting inflation—recovery of pandemic-stalled supply chains—is already harvested, and the rest will have to come from tamping down demand, which may have to come from further rate hikes.

· The Fed is very unlikely to make any changes to interest rates at the January 31 meeting. FOMC voters want to see if inflation continues to decline as it has over the past six months. If inflation comes in hot over the next two or three months, however, rate hikes might be back on the table in Q2.

· FOMC voters have said over and over that 2% is the target. Getting inflation down to 2-ish (say 2.5%) is probably not good enough. If we’re still at 2.5% at the end of the year and the job market is in decent shape, I think it’s more likely that they’ll be hiking instead of cutting.

I. What the Fed looks at when making interest rate decisions

By law, the Fed considers inflation (target of 2%) and employment when making interest rate decisions. In theory, raising interest rates (making it harder to do business and buy things on credit) reduces inflation and employment, while cutting interest rates (making it easier to do business and buy things on credit) raises inflation and employment. They also watch total economic growth (GDP) closely. Let’s see where we are on each of these measures.

A. Inflation

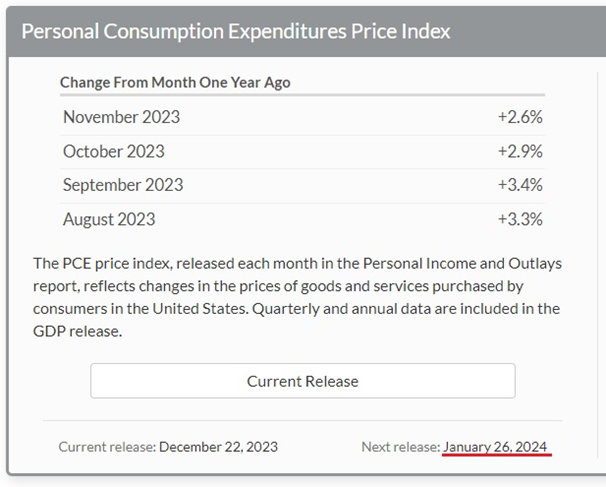

Here’s the most recent inflation report from the Bureau of Economic Analysis:

As you can see, inflation is heading in the right direction towards the Fed’s 2% target. However, after stripping out volatile food and energy prices (which the Fed normally does) and looking at everything else, prices increased 3.2% from November 2022 to November 2023. Drilling down into the prices for services (taking out goods), that number increased 4.1%. Given that the U.S. economy is largely service-based and labor markets are very tight, there’s a lot of yellow flags in this inflation report. Fed policymakers will be looking closely at the next inflation data release on January 26, and subsequent months, to see if this trend towards 2% holds.

B. Labor data

The January 5 Employment Situation Summary showed the unemployment rate at 3.7%, a very low number by historical standards.

The Fed’s legal mandate is to maintain price stability while promoting full employment. With the long-run average of U.S. unemployment at 5.7% (counting recessions), the current 3.7% is already at or above full employment. It’s hard to argue that rates should be cut in order to boost job growth when there aren’t enough workers to fill job openings as it is.

C. Overall economic growth (GDP)

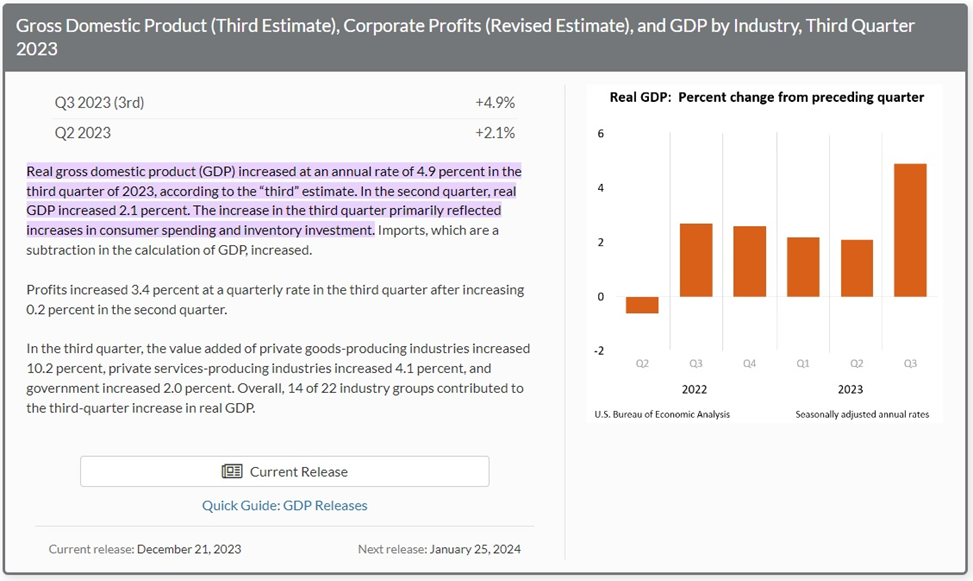

Overall economic growth was extremely strong (4.9%) in Fall 2023:

Source: BEA

Everyone expects that rate to fall over the coming year (4.9% is not sustainable) but the question is by how much. The U.S. economy’s long-term growth rate is estimated to be around 2% in real terms. Generally, you cut interest rates to stimulate the economy, and an economy growing at 2% or above does not need to be stimulated.

II. What does the market think is going to happen?

Based on short-term yields on instruments such as T-bills (see below), the market is expecting three 0.25% rate cuts over the course of the year, with one likely to come in the first half of the year, and two more in 2H:

Source: U.S. Treasury

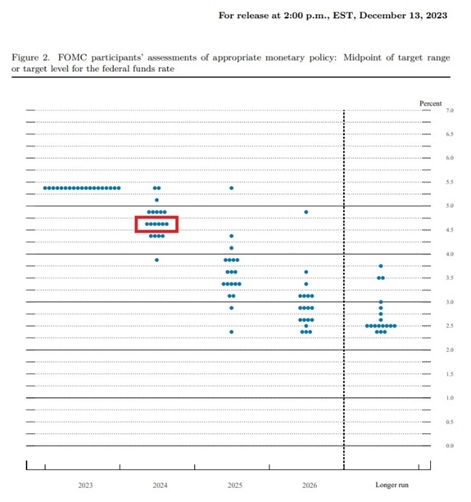

The Federal Reserve’s most recent Summary of Economic Projections (SEP, see below), says that Federal Reserve officials think they will end up cutting rates three times in 2024. People often get confused about what the SEP is—it isn’t an indication of what Fed officials intend to do. It’s a forecast of what they think they will end up doing IF other economic variables unfold according to their forecasts.

Source: Federal Reserve

In other words, the above forecast is contingent on other parts of the forecast being correct. In the context of the SEP, Federal Reserve officials think they will cut rates by 75 basis points IF GDP growth declines to 1.4% (a significant slowdown from the 2.5-3% growth we’ve seen in 2023), unemployment increases to 4.1% (from the current 3.7%) and/or inflation declines to 2.4% (down from the current 3.2%). If any one of those things doesn’t happen, it’s possible that the Fed won’t take the same actions as the forecast predicts. If any of these variables go in the opposite direction, it’s possible that the Fed would take the opposite action from the forecast—rate hikes!

III. What the Fed said

The Fed itself laid out the criteria for going in the opposite direction. The Federal Open Market Committee (FOMC)—the decision-making body within the Federal Reserve that sets interest rates—meets eight scheduled times per year. The FOMC releases a short statement at the conclusion of each meeting with the rate decision, and then releases a longer summary of their meeting minutes about a month later. On January 3, the FOMC released the minutes from their December 2023 meeting.

For me, the most important passage in the December minutes was this:

“Participants observed that inflation remained above the Committee’s objective and that they would need to see more evidence that inflation pressures were abating to become confident in a sustained return of inflation to 2 percent.” (emphasis added)

Although inflation has been coming down, a big part of that has come from the healing of disrupted global supply chains. Several voters thought that the inflation reductions coming from repair of global supply chains is largely done, and future reductions in inflation need to come from slowdowns in demand. Some voters thought that further loosening of the labor market and increased housing supply will help tame inflation in the coming months. Ultimately, any of these theories could be right but the main message here is that the Fed is going to respond to whatever the inflation numbers say. So if you’re betting on rate cuts, you’re implicitly betting that inflation is going to continue cooling down. How confident are you about that outcome?

The meeting minutes stressed that FOMC voters themselves aren’t highly confident. FOMC participants “perceived a high degree of uncertainty surrounding the economic outlook” and identified a number of upside risks to inflation, including high household spending capacity, geopolitical risks to food and energy prices, and onshoring raising labor demand. Language that the “policy rate as likely at or near its peak for this tightening cycle” (emphasis added) tells me that the Fed wants to keep the door open for further rate hikes in 2024. If they remove the “or near” language from that sentence, I’d interpret that as them being ready to move in the direction of cuts.

The theme of uncertainty extends to recent Fed speeches. Richmond Fed President Barkin’s January 3 speech emphasized the importance of responding to incoming data, and noted that “the potential for additional rate hikes remains on the table.” Barkin clearly laid out his decision criteria: “is inflation continuing its descent and is the broader economy continuing to fly smoothly? Conviction on both questions will determine the pace and timing of any changes in rates.”

New York Fed President Williams sounded more confident in a November 30 speech. He noted that interest rates are at their most restrictive stance in 25 years, and that he believes that the current level of interest rates are at or near the highest level they will go in the current hiking cycle. However, Williams added that he expected rates to be restrictive for an extended period of time—doesn’t sound to me like Williams is going to be in a mood to be cutting soon.

IV. Looking to the future

A. What it would take for the Fed to cut rates

For the Fed to cut rates three times as priced in by the market, the economic data need to unfold in the way the Fed predicted. That means there needs to be a significant slowdown in GDP growth to a meager 1.4%, inflation needs to continue trending downwards towards 2%, and unemployment needs to climb somewhat. I think all three of those things are question marks. A recession could certainly get us there—a big spike in unemployment, a sharp slowdown in demand pushing prices down, and a general contraction in economic activity.

My big question is I don’t know what gets us into a recession. We already had a mini-recession in early 2022 as the startup tech bubble collapsed, with 1-2 rounds of layoffs at many of the big tech firms. But that mini-recession was pretty isolated to the white-collar sector of the economy. More blue-collar sectors like hospitality, travel, healthcare, and social services are experiencing steady growth. I think there is more white-collar pain to come as the commercial real estate refinancing crunch hits in force, and medium-to-large corporates start to have trouble with cash flows as they have to refinance debt at higher interest rates. I think that’s the most likely catalyst for a big slowdown in economic activity, and a Fed rate cut in that environment would have the dual purpose of generally stimulating economic activity and also easing the refinancing burden for overindebted buildings and corporates.

B. What it would take for the Fed to hold steady

I think the Fed will hold steady if inflation comes down a little but not enough. If inflation comes down from the current 3.2% by a small amount each month (e.g. steady progress), then the Fed may just hold and wait to see if they can get to a ~2% level over the next 12 or 15 months. Unemployment also needs to stay in the 3-4.5% or so range for this to happen.

C. What it would take for the Fed to hike

If GDP continues to run hot, unemployment stays sub-4%, and most importantly PCE stops trending downwards as it has been, I think it’s very likely that we will see further rate hikes this year. Even if we get unemployment ticking up to the 4-4.5% range, and inflation staying around 3%, that’s probably enough to see another rate hike or two this year.

V. Conclusion

It's far from guaranteed that we are going to see 3 rate cuts this year. For that to happen, we need to see steady declines in inflation every month between now and April--something that's far from a given, because there are several factors that could actually push inflation up. If inflation moves sideways we could even see another hike or two. If you are putting off some major purchase or business decision on the expectation that "rates will fall," well, you might be waiting for a while.