Today’s 2.7% CPI Release Is Nothing to Celebrate

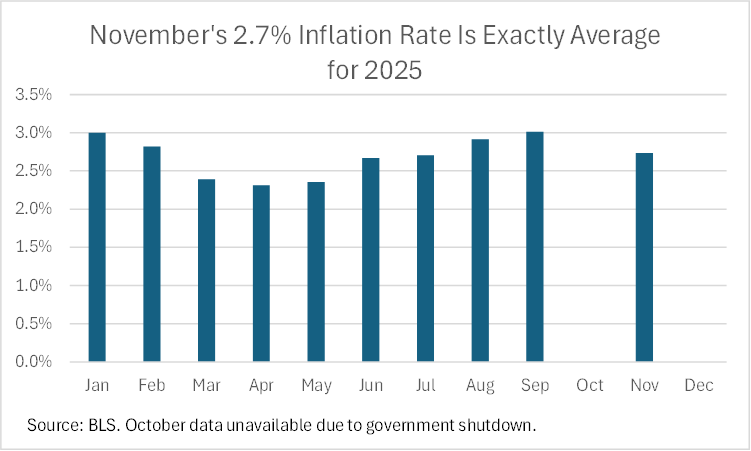

The market and the White House are celebrating today’s cooler-than-expected Consumer Price Index (CPI) data release, which came in at 2.7% annualized inflation from November 2024 to November 2025.

However, I don’t see anything to celebrate.

2.7% Is Par for the Course for 2025—and That’s Not Good

Although the market reacted positively to November’s CPI reading coming in at 2.7% relative to the 3.0% reading in September (“giving the Fed more room to cut,” which I think they shouldn't), I don’t see this as a good number. November’s print is exactly the average for 2025.

- Inflation merely declining to the 2025 average is not good enough, because 2.7% is enough to make people upset. Pick your poll of choice—I grabbed this random one from Politico with a quick Google search—and they all show that cost of living is one of the top, if not the top, concern for people living in the U.S, and this concern is based on 2.7% inflation over most of this year. Inflation climbing to 3% (see next two points) would be very bad news for the White House.

- Several economists have pointed out that the November numbers are not to be trusted, because they only pick up half of the month due to the government shutdown. In particular, sales and discounts surrounding Black Friday may weigh heavily in the November data (since it only covers the last two weeks), showing the inflation rate for the month to be artificially low. If this is true, we will see a big spike in December when the sales discounts are flushed out of the monthly data.

- It is possible that the full impact of tariffs has not been felt yet. A number of Fed officials have warned that businesses have been holding off on raising prices as long as possible, and executives have communicated to the Fed that they intend to raise prices in Q1 of next year. If this is true, we will see an acceleration in inflation, rather than a deceleration, over the next three months.

Inflation Continues to Hit the Poor the Hardest

Prices are climbing the fastest in non-discretionary categories. Some takeaways on specific numbers, from November 2024 to November 2025:

Food price inflation (2.6%) continues to hit hard

- Although the Fed officially looks through food prices in setting the interest rate, increases in the cost of food hit low-income households the hardest.

- Meat prices rose 4.7% over the past year, driven by beef climbing 15.8%. Chicken and pork went up a lot less. Eggs are -13.2% cheaper than this time last year.

- Coffee prices went up 18.8% over the past year, certainly tariff-driven.

Power costs are also climbing sharply (7.4%)

- Electricity costs went up 6.9%, while utility gas went up 9.1%.

- The sharp increases in power prices are likely due to AI-related data center buildouts. Gas prices rose because ~43% of U.S. electricity production comes from natural gas (EIA).

No end in sight to increases in healthcare costs (3.3%)

- Healthcare costs have been rising faster than the general rate of inflation for most of the last 18 months at least, and probably longer.

- Hospital services rose 5.7%.

- Home health care for elders went up 10.8%.

- Based on the CPI’s methodology for insurance costs, the numbers suggest that insurers are passing on most of these cost increases to customers in the form of higher premiums.

Car prices – the poor can’t catch a break

- The price of used cars went up by 3.6%, while new cars went up only 0.6%.

What I’m Watching Going Forward

Three questions that are top of mind for me on inflation:

- Are the incomplete November data truly contaminated with Black Friday discounts? If yes, we will see a big spike in inflation in the December data.

- Will businesses raise prices significantly in Q1 of next year? If yes, we will see a spike in inflation in the Feb 2026-Apr 2026 data.

- Will Trump’s reversal of tariffs on imported food items, like coffee, and accelerating import of Argentinian beef help the food inflation picture over the next few months? (Likely it will, but cost of healthcare, power, and housing will continue to climb)