FOMC Preview - February 2023 meeting

TL;DR – I believe the Fed will raise rates by 0.25% at the February 1 meeting. However, recent speeches by DC-based officials sound hawkish to me and I think 0.50% is still possible.

Market pricing suggests the Fed will hike twice at the next two meetings—25 and 25—and then stop. My out-of-consensus view is that the Federal Open Market Committee (FOMC) could hike much more than the market expects and even the Fed’s own projections indicate—a couple members (including Powell) have said that the ultimate peak of rates could be higher than what the Fed has projected in the past. My opinion is driven by a view (not widely held at the Fed) that inflation is largely a function of government liabilities, and if government liabilities continue to expand faster than the rate of GDP growth,[1]that will continue to put demand-side inflationary pressure on the economy.

Key takeaways

· “Inflation remains far too high” or some variant of this phrase has shown up in several speeches.

· Core services inflation is the focal point for most FOMC members. People don’t seem too concerned about energy prices or goods inflation. Several members expect housing prices to fall and look at new leases data as a leading indicator.

· Members who want to take the foot off the gas in terms of rate hikes point to the Fed reducing its balance sheet as an additional source of monetary tightening that is ongoing (perhaps justifying slower or fewer interest rate hikes).

· By contrast, several members cited the experience of the 1970s as a cautionary tale in the Fed taking its foot off the gas too early.

· Overall, the regional Fed presidents seem more dovish to me than the DC-based Board of Governors members.[2]My guess is that this is because the regional presidents spend more time talking to local business leaders, and hear more anecdotal stories of hiring freezes, impending layoffs and general reductions in corporate spend.

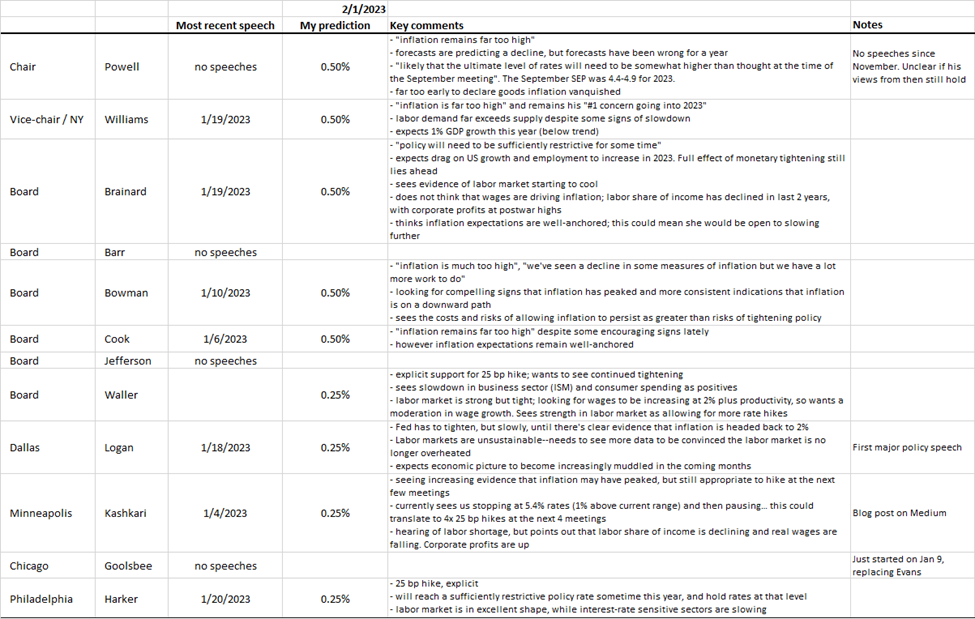

Individual vote predictions (summary table on next page)

· I am pretty sure at least four FOMC members will vote for a 0.25% hike: Waller/Board and Harker/Philadelphia have explicitly stated that they will vote for 25 bps, while Logan/Dallas and Kashkari/Minneapolis have strongly hinted at 25.

· Williams/NY, Brainard/Board, Bowman/Board, and Cook/Board all sounded more hawkish than the previous four in recent speeches, so I think it’s possible that they would vote for 0.50% increases. But they haven’t hinted directly at 25 or 50 so my confidence in calling that they would vote for 50 is low.

· Powell hasn’t given a policy speech since November of last year, but that speech sounded more hawkish to me than any of the other recent comments. If he hasn’t changed his opinion in the past two months I would expect him to vote for 50, but it’s been radio silence from him so I don’t have much confidence in that prediction either.

· There haven’t been recent monetary policy speeches from Barr/Board or Jefferson/Board. Goolsbee/Chicago just started two weeks ago and hasn’t given a policy speech yet.

· Since I’m almost sure 4 will vote for 25, and I’m not sure if the remaining 8 will go for 25 or 50, I average this out to a 25 prediction for February.

[1]For example, the perhaps-wrongly-named Inflation Reduction Act may turn out to be significantly inflationary as many of its provisions are uncapped in terms of federal government spend.

[2] Recall that the FOMC has 12 members, 7 who are DC-based and 5 who come from regional Fed banks. This group of 12 meets every 6 weeks to set the benchmark interest rate for the U.S. economy.